Program Director

Raj Chetty is the William A. Ackman Professor of Economics at Harvard University, where he also directs Opportunity Insights, a research organization that studies economic mobility. His research focuses on the measurement and explanation of mobility across income and social strata, with particular attention to the role of government policies. He has been an NBER affiliate since 2003.

Featured Program Content

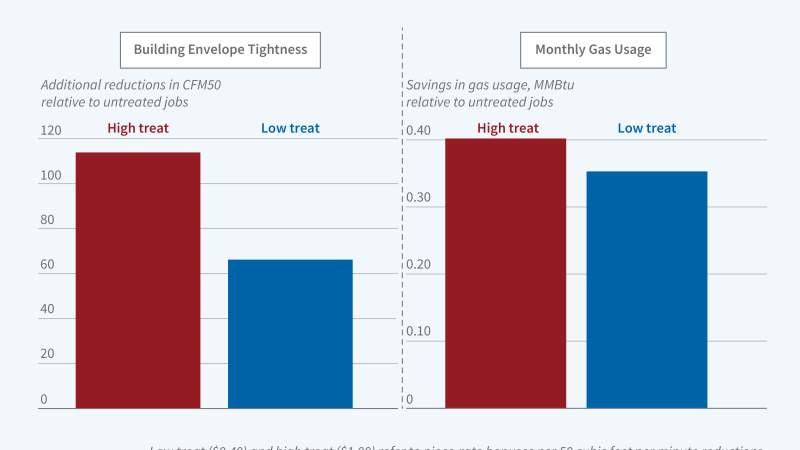

In a program designed to save energy by promoting home weatherization among low-income households, compensating contractors based on the amount of natural...

Supported by the Alfred P. Sloan Foundation, the National Science Foundation, and the Lynde and Harry Bradley...

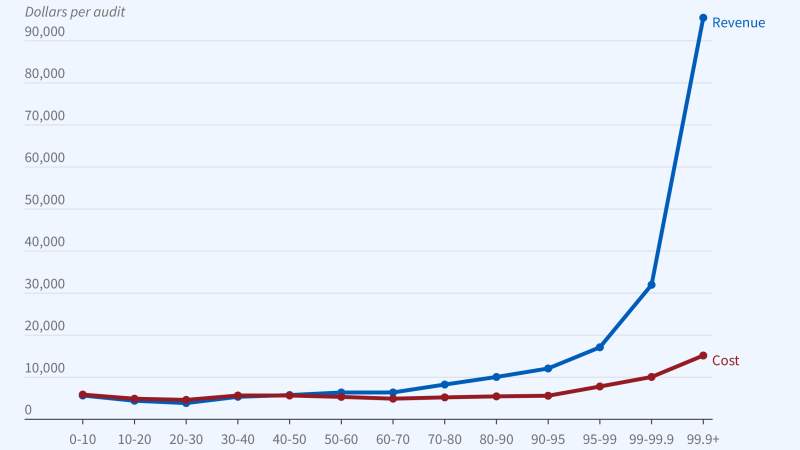

The US Internal Revenue Service (IRS) estimates that in the middle of the last decade, underreporting of income on individual income tax returns accounted...