Codirectors

Antoinette Schoar is the Michael M. Koerner (1949) Professor of Finance and Entrepreneurship at the MIT Sloan School of Management. Her research includes entrepreneurship and small business finance, household finance, and intermediation in retail financial markets. She has been an NBER affiliate since 2001.

Amir Sufi is the Bruce Lindsay Professor of Economics and Public Policy at the University of Chicago Booth School of Business. His research focuses on finance, macroeconomics, and the links between the two. He has been an NBER affiliate since 2009.

Featured Program Content

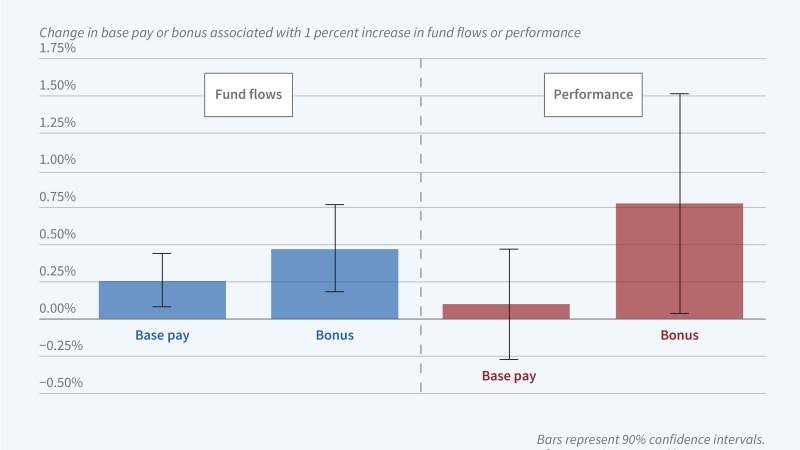

Actively managed mutual funds, which pool money from many investors and invest it in stocks, bonds, and other financial assets, are an important part of the US...

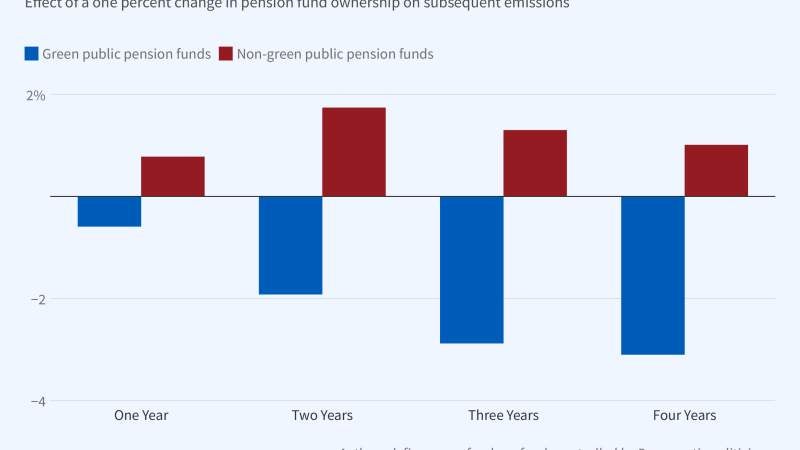

Many institutional investors have objectives that include reducing the carbon footprint of their portfolios. The primary strategies through which investors...

There is surprisingly little empirical evidence on how households choose among complex financial products such as mortgages. A key reason is the difficulty...